I am not a tax attorney or tax consultant. I’m merely an undergraduate student at the University of Pennsylvania, and the Co-Chair of the International Student Advisory Board.

IRS Form 1098-T, which educational institutions issue to students as a tuition statement for tax purposes, is used by many American families to claim educational credits or deductions on their federal tax returns.

Should international students have this form?

It’s complicated. In many situations, yes.

Universities often will choose not to issue this tuition statement to international students because those students can’t do anything with it. ← If I had to write this with footnotes, there would be a million asterisks next to that sentence; keep reading. We’ll return to this question below.

Are international students able to use this form for anything?

Most international students are ineligible to claim those educational credits/deductions because they are nonresident aliens (e.g. F-1 student). Hence, these individuals would not benefit from having the 1098-T.

Some, especially graduate students, may be eligible to claim credits/deductions because…

- they are resident aliens per the substantial presence test, particularly after the 5th year of being in the United States;

- they are nonresident aliens for immigration, but resident aliens for tax purposes as the spouse of an American citizen or resident alien; or

- they are nonresident aliens for both immigration and tax purposes, but eligible dependents of parents who are resident aliens/permanent residents/citizens; those parents are able to claim these credits in certain situations.

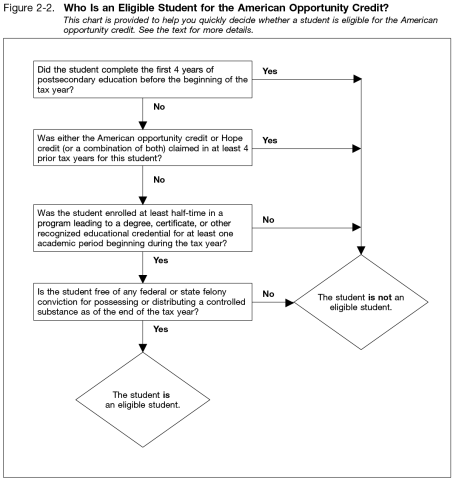

Figure 2-2 from IRS Publication 970, illustrating who is an eligible student for the American Opportunity Credit. Note: not all eligible students can claim. See Publication 970 for a flowchart of who is eligible to claim.

I am an international student in the above categories. Can I get a 1098-T from my school?

The IRS says that universities “do not have to file Form 1098-T or furnish a statement for… nonresident alien students, unless requested by the student“. Additionally, they are not required to provide it for “students whose qualified tuition and related expenses are entirely waived or paid entirely with scholarships”.

You must still meet all of the other requirements to get a 1098-T:

- Attend an eligible educational institution (college, university, vocational school, or other postsecondary educational institution in §481 of the Higher Education Act)

- Have paid qualified tuition and related expenses in that tax year

- i.e. tuition, fees, course materials required to be enrolled

- does not include room, board, insurance, medical expenses including student health fees, transportation, and personal/living/family expenses

- Receive credit for the completion of course work leading to a postsecondary degree, certificate, or other recognized postsecondary educational credential

- i.e. most undergraduate bachelors programs and graduate masters and PhDs are fine

- continuing education is often not included

- Be enrolled in any academic period of that tax year (consult IRS instructions for exceptions)

- Have provided your SSN or ITIN to the educational institution either through student records or an additional Form W-9S

What are some potential hurdles?

I was in a situation this year where my university did not issue me a 1098-T, and responded to my request with a form letter:

Does every Penn student receive a 1098-T?

Penn does not provide a 1098-T to non-resident aliens, or any student whose qualified charges are fully funded by grant, scholarship or tuition waivers, or any student who was enrolled in non-credit courses during the academic year.

They additionally stated,

“Though you might have received a 1098t form in the past, going forward as a Canadian citizen you will not receive one.”

As I’ve explained above in this post, this determination was a mistake. It conflates citizenship & immigration status with residency for tax purposes, and ignores the possibility that someone else other than me may be eligible to claim the credit.

Furthermore, even if I were a nonresident alien ineligible to claim the credit, nothing in the IRS regulations for Form 1098-T gives the educational institution the right, responsibility, or power to determine whether I might be eligible to claim the credit; nor does it permit them to deny a Form 1098-T to a nonresident alien’s request.

I’m not a lawyer.

Neither are the people at Penn who decided initially that I wouldn’t get a statement. But apparently I’m capable of reading the IRS documents and figuring out for myself what I’m entitled to.

What does this situation reveal about international students?

First, on the superficial level, this situation reveals that immigration status and residency for immigration purposes differs from tax status and residency for tax purposes. Clearly, not all employees who handle these cases are aware of these stipulations.

More importantly…

Even if we define international students to be non-citizens and non-permanent residents of the United States, this constituency is large, diverse, and varied, with complex needs based on their individual families’ statuses. It is a mistake to define broad, indiscriminate policies that treat all international students identically.

If you think I’ve made a mistake in this post, or wish to disagree with my conclusion here, I’d like to hear from you. Comment below or send me an email using the contact form.